New Income Tax Bill 2025 LIVE Updates: FM Nirmala Sitharaman to Present I-T Bill in Parliament at 2 PM Today; A Look at Proposed Amendments, Simplifications, and Key Updates.

New Income Tax Bill 2025 LIVE Updates

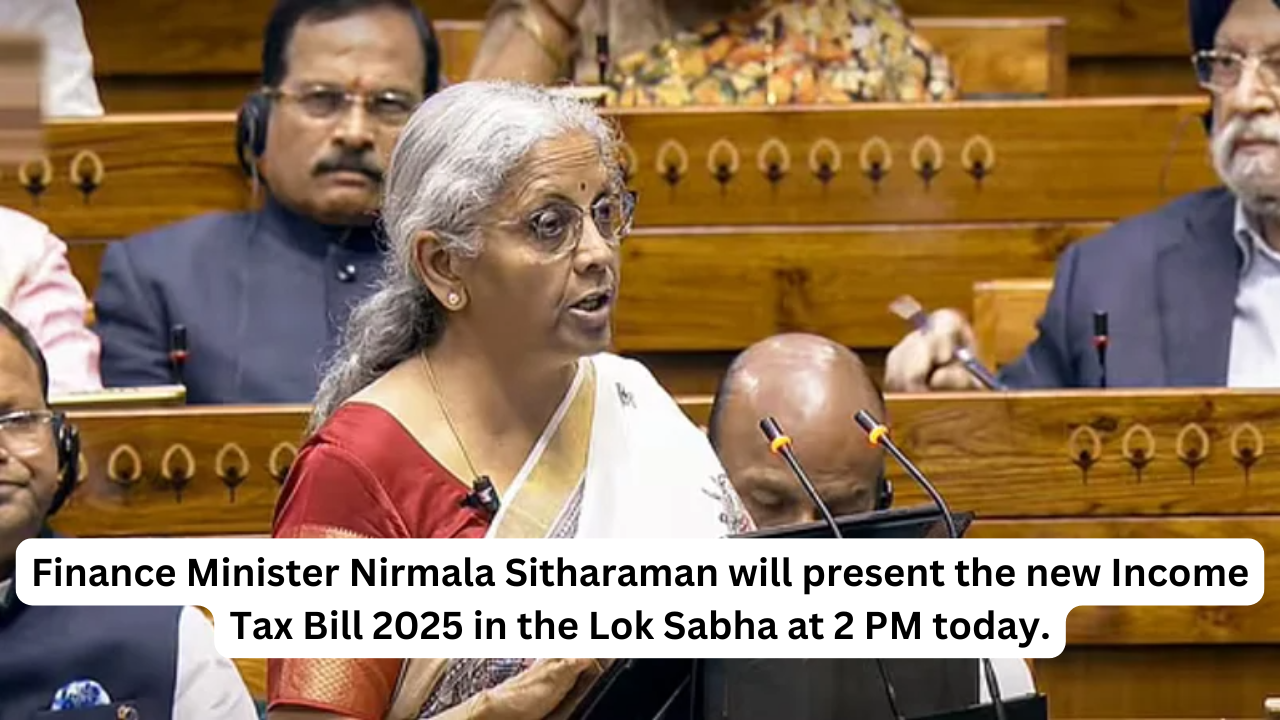

Union Finance Minister Nirmala Sitharaman will present the new Income Tax Bill 2025 in the Lok Sabha at 2 PM today. The bill was first announced in her Budget speech on February 1 and was later approved by the Cabinet on February 7.

What Happens Next?

Once the Lok Sabha passes the bill, it will be sent to the Parliament’s Standing Committee on Finance for further discussions. After that, the bill will go through both Houses of Parliament again before becoming law.

The new I-T Bill 2025 is 622 pages long and is set to replace the 60-year-old Income Tax Act of 1961. Once passed, it will be known as the Income Tax Act, 2025, and is expected to take effect from April 2026.

What FM Nirmala Sitharaman Said

On February 8, while speaking to the media, Sitharaman said:

“I hope to introduce the new Income Tax proposal in the Lok Sabha next week. After that, it will be sent to a committee. Once the parliamentary committee reviews and makes recommendations, the bill will go back to the Cabinet for approval. After that, it will again be introduced in Parliament. There are still three important steps left.”

Why Is This Bill Important?

The new I-T Bill 2025 is part of a major effort to reform India’s tax system. It aims to simplify tax rules, reduce disputes, and create a more transparent and efficient tax system.

Timeline of the New I-T Bill

- July 2024: FM Sitharaman first announced a review of the Income Tax Act, 1961.

- CBDT (Central Board of Direct Taxes) set up a committee to simplify and clarify tax laws.

- 22 sub-committees were formed to review different sections of the Income Tax Act.

How Will the New I-T Bill Affect You?

The new tax bill is designed to make tax rules simpler and easier to understand. It may reduce the number of tax sections by 25-30%, making the system less complicated for taxpayers.

Stay tuned for more updates!

Also Read: Live: PM Modi Meets US Intelligence Chief Tulsi Gabbard, Set for Bilateral Talks With Trump

+ There are no comments

Add yours